Articles

The newest Gold started in 2019 from the Kirill Bensenoff and you may Alex Shvayetsky. They supply a variety of personal currency financial loans including improve and you can flip, leasing, surface up-and signature loans. Lima One to Money depends inside Greenville, South carolina and you can founded from the previous Marines.

Multi-Family Money

Joshua Holt are a licensed mortgage creator (NMLS # ) and inventor away from Biglaw Individual. Their financial solutions is founded on the areas from top-notch mortgages, particularly for solicitors, medical professionals or any other large-income professionals. Ahead of Biglaw Individual, Josh practiced personal security mergers & order legislation for example of your prominent lawyers regarding the country. Effortless Highway Financing’s EasyFix mortgage program will bring boost and flip finance to have investors to buy attributes. The leasing money finance are versatile and flexible, providing the fresh leverage you need and also the reliable investment your require. All of our flexible FixNFlip financing clarify the newest approval procedure and permit you to go easily, maximize your influence, and you may rotate when needed.

- It means they can render far more designed mortgage terminology to meet the brand new borrower’s book demands.

- After you have a list of possible lenders, take care to evaluate its terms, rates of interest, and you can charges to be sure you will get an informed package you’ll be able to.

- Find the power of private lending to possess Illinois a home investments which have Lima You to Financing.

- As the their first in 2011, Lima One to Funding has financed more than $9 billion in the financing for real estate traders who are building, improving, and stabilization neighborhoods in the united states.

Boost And you will Flip Fund

The brand new current incident is not the first-time that cash has fallen away from a relocation vehicle in recent years. But it opted at hand the brand new secrets to Busey instead of you will need to refinance this building in the a reduced friendly interest environment compared to the if it borrowed. Obvious Peak, and therefore owns more than 100 industrial and you can commercial features in the Midwest, gotten the new Oak Brook workplace to possess $13 million in the 2018 as part of a m&a which have trader Ryan Corcoran. The price try a great deal during the time, while the assets fetched more $20 million in the 2001, DuPage Condition info let you know. Panko’s buy are financed that have a great $ten.5 million financing from Lakeside Lender, public record information tell you. It may lead to the introduction of merchandising on the a portion of the house as he takes into account redeveloping a slice one’s very apparent, considering a press release.

Chicago and Arizona, D.C., Among Metropolitan areas Well suited for Work environment-to-Co-Life Conversion rates

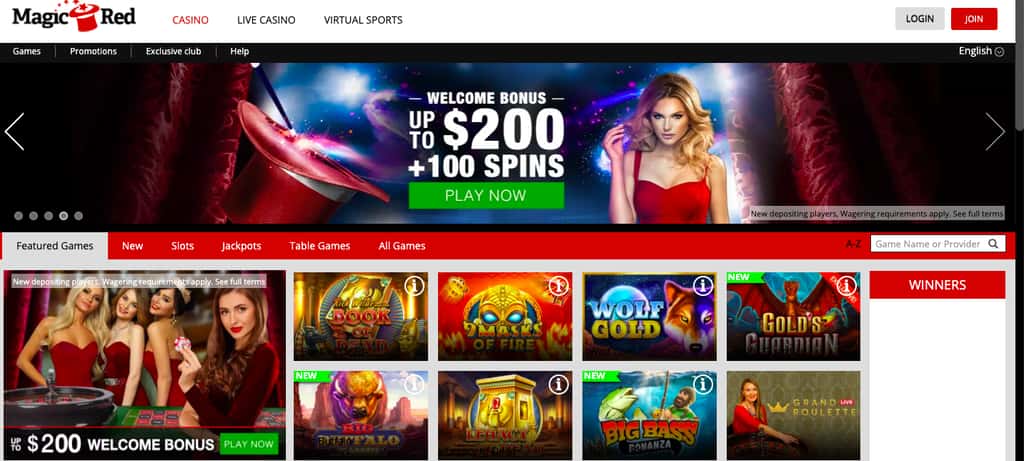

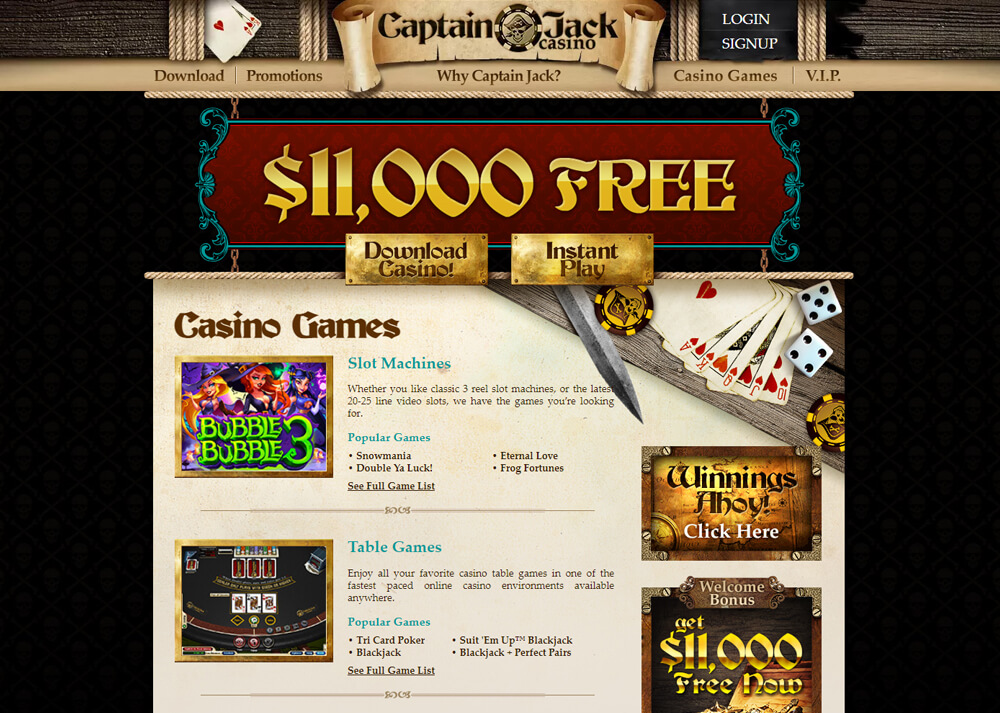

The newest MGM part provides some gambling games having slots and you can online dining table online game on the industry’s best software designers. Real- https://vogueplay.com/uk/blazing-star/ money web based casinos supply the world’s finest casino games to help you qualified players inside the court states. Greatest a real income casinos were popular makes such as BetMGM, the new Caesars Palace On-line casino, DraftKings, and FanDuel. The scale and you will growth of the new Chicago local rental property field try promising to have investors.

They provide short-term enhance and flip money and you will money spent fund. Closure as quickly as 5 business days, subject to obvious term. Private lending financing specializing in individuals loan models, along with bridge finance, enhance and flip money, ground-upwards money, and you can refinance fund.While we try resource-founded … NuWay Home loan are personal money-lender situated in Chicago, IL. They offer brief connection fund, refinancing, and you may short term enhance and you may flip money. Clarence finds out a property on the Lake North subdivision of Chicago, IL so you can renovate and sell.

If you’re considering a hard currency mortgage in the Chicago, you will need to shop around and get a reliable bank. One method to discover a reputable hard loan provider is to inquire about suggestions off their a house buyers in your community. You can also search on the internet to own difficult currency loan providers within the Chicago and read analysis out of earlier customers. An arduous currency mortgage could offer individuals plenty of advantages. Filled with bringing use of the newest investment they require whenever other lenders could have turned him or her off. Such finance normally arrive easily, too, and therefore borrowers can purchase a house in the a primary period of time.

Nether I, nor any kind of my children could have had money to have a visit such as this once they in which inside the university. As he returned the guy been school from the Columbia College within the Nyc. It is at this time the guy wants people to call him Barack — maybe not Barry. After Columbia, the guy went to Chicago to function while the a residential district Organizer to have $several,one hundred thousand a year.

Complete Illinois Market Fashion

EquityMax registered the fresh fold, providing a good “no assessment” substitute for ensure the brief closing the fresh borrower are asking for. At the EquityMax, we think in the with our customers talk myself to the employers. We have been a family group owned-and-operate lender of our financing. Proprietors of your own team is the ultimate decision suppliers and you will are happy to have a chat individually along with you regarding the type of investment means on each each owning a home venture.

Rather than traditional bank loans otherwise credit unions, tough money money are usually provided by personal someone or organizations. Such money is actually safeguarded by the a property and so are usually made use of because of the individuals who may not be eligible for old-fashioned investment because of issues such bad credit or strange assets brands. Hard money fund routinely have higher interest rates and reduced fees words compared to antique finance, nonetheless they offer quick access to money for real estate opportunities or other financial demands. Overall, difficult currency credit are an important funding for real property investors and you can investment property people in the Chicago who are in need of immediate access to help you money and delight in the flexibility out of tough currency fund. In comparison with antique financial institutions, difficult money lenders provide a good speedier app processes, quicker stringent conditions, and monetary options customized to the requires out of local investors. Difficult currency loan providers Chicago give a new option to a property buyers and you may home owners looking to benefit from investment potential.